UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14A-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 | |

CORTLAND BANCORP

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Cortland Bancorp

194 West Main Street

Cortland, Ohio 44410

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

PROXY STATEMENT

Annual Meeting: | May 10:00 a.m., EDT | Squaw Creek Country Club 761 Youngstown-Kingsville Road Vienna, Ohio 44473 | ||

Record Date and Voting: | 5:00 p.m., EDT, April | |||

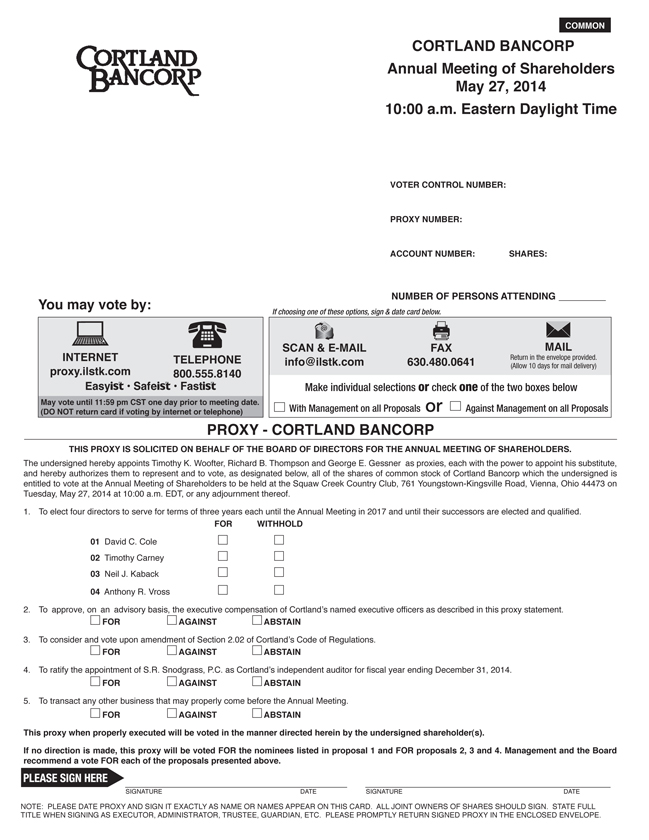

| Agenda: | 1. To elect

2. To approve, on an advisory basis, the executive compensation of Cortland’s named executive officers as described in this proxy statement.

4. To ratify the appointment of S.R. Snodgrass,

5. To transact any other business that may properly come before the Annual Meeting. | |||

| Proxies: | Unless you specify on the proxy card to vote differently, the management proxies will vote all signed and returned proxies “FOR” election of the Board’s nominees for director, “FOR” approval of executive compensation, | |||

Proxies Solicited By: | Proxies are being solicited by the Board. The cost of the solicitation is being borne by Cortland. Proxies will be solicited by mail and may be further solicited, for no additional compensation, by officers, directors, or employees of Cortland and its subsidiaries by mail, telephone, or personal contact. Cortland will also pay the standard charges and expenses of brokerage houses, voting trustees, banks, associations, and other custodians, nominees, and fiduciaries who are record holders of common shares not beneficially owned by them, for forwarding proxy materials to, and obtaining proxies from, the beneficial owners of such common shares. In addition, we have retained Advantage Proxy to assist us in soliciting proxies. For these services, we will pay Advantage Proxy a fee of $4,500 plus reasonable expenses. | |||

| Mailing Date: | We anticipate mailing this proxy statement on or about April | |||

| Revoking Your Proxy: | You may revoke your proxy before it is voted at the Annual Meeting. You may revoke your proxy by:

• sending written notice revoking your proxy to Timothy Carney, Cortland’s Secretary, at 194 West Main Street, Cortland, Ohio 44410, which must be received prior to the Annual Meeting;

• sending in another signed proxy card with a later date, which must be received by Cortland prior to the Annual Meeting; or

• attending the Annual Meeting and revoking your proxy in person if your common shares are held in your name. If your common shares are held in the name of your broker, financial institution, or other holder of record, you must bring an account statement or letter from the broker, financial institution, or other holder of record indicating that you were the beneficial owner of the common shares on the record date. | |||

Attendance at the Annual Meeting will not, in and of itself, constitute revocation of a proxy.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDERANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 28, 2013:27, 2014: THE PROXY STATEMENT, INCLUDING NOTICE OF THE ANNUAL MEETING OF SHAREHOLDERS, AND FORM 10-K ARE AVAILABLE AT www.cortland-banks.com/invest.

PROXY STATEMENT

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

Delivery of Proxy Materials to Shareholders Sharing an Address | 18 | |||

| 19 | ||||

PROXY STATEMENT

Cortland Bancorp, an Ohio corporation (Cortland), is registered as a financial holding company and a bank holding company with the Board of Governors of the Federal Reserve System and owns all of the issued and outstanding common shares of The Cortland Savings and Banking Company (the Bank). Cortland’s principal executive offices are located at 194 West Main Street, Cortland, Ohio 44410. Cortland’s common shares are traded on the Over the Counter Bulletin Board under the symbol CLDB. As used in this proxy statement, the terms “we,” “us,” and “our” refer to Cortland and/or its subsidiaries, depending on the context.

This proxy statement is furnished in connection with the solicitation by Cortland’s Board of Directors (the Board) of proxies to be voted at the 20132014 Annual Meeting of Shareholders, including any adjustment or postponement of such meeting (the Annual Meeting). The Annual Meeting will be held on Tuesday, May 28, 2013,27, 2014, at 10:00 a.m., EDT, at Squaw Creek Country Club, 761 Youngstown-Kingsville Road, Vienna, Ohio 44473. The accompanying Notice of Meeting and this proxy statement are first being mailed to shareholders on or about April 19, 2013.18, 2014.

SHARE OWNERSHIP BYOF DIRECTORS AND EXECUTIVE OFFICERS

The following table furnishes information regarding the beneficial ownership of common shares, as of March 22, 2013,April 14, 2014, for each of the current directors, each of the director nominees, each of the individuals named in the Summary Compensation Table, and all current directors and executive officers as a group. To the knowledge of Cortland, no person beneficially owns more than 5% of the outstanding common shares of Cortland. The mailing address of each of the current executive officers and directors of Cortland is 194 West Main Street, Cortland, Ohio 44410.

Name of Beneficial Owner | Sole Voting or Sole Investment Power | Shared Voting or Shared Investment Power | Total Shares | Percent of Common Shares Outstanding (1) | Sole Voting or Sole Investment Power | Shared Voting or Shared Investment Power | Total Shares | Percent of Common Shares Outstanding (1) | ||||||||||||||||||||||||

Jerry A. Carleton | — | 11,371 | (4) | 11,371 | (2 | ) | ||||||||||||||||||||||||||

Timothy Carney(3) | 19,825 | (5) | 5 | (6) | 19,830 | (2 | ) | 19,863 | (4) | 5 | (5) | 19,868 | (2 | ) | ||||||||||||||||||

David C. Cole | 1,880 | 2,160 | (7) | 4,040 | (2 | ) | 2,793 | 2,192 | (6) | 4,985 | (2 | ) | ||||||||||||||||||||

Stanley P. Feret(3) | 1,000 | — | 1,000 | (2 | ) | |||||||||||||||||||||||||||

James M. Gasior(3) | 11,479 | (8) | — | 11,479 | (2 | ) | 13,306 | (7) | — | 13,306 | (2 | ) | ||||||||||||||||||||

George E. Gessner | 29,221 | — | 29,221 | (2 | ) | 29,221 | — | 29,221 | (2 | ) | ||||||||||||||||||||||

James E. Hoffman, III | 5,159 | — | 5,159 | (2 | ) | 6,225 | — | 6,225 | (2 | ) | ||||||||||||||||||||||

Neil J. Kaback | 2,691 | — | 2,691 | (2 | ) | 3,691 | — | 3,691 | (2 | ) | ||||||||||||||||||||||

Joseph E. Koch | 9,957 | — | 9,957 | (2 | ) | 9,957 | — | 9,957 | (2 | ) | ||||||||||||||||||||||

Joseph P. Langhenry | 8,300 | — | 8,300 | (2 | ) | 8,300 | — | 8,300 | (2 | ) | ||||||||||||||||||||||

David J. Lucido (3) | 10,708 | (8) | — | 10,708 | (2 | ) | ||||||||||||||||||||||||||

Richard B. Thompson | 137,340 | — | 137,340 | 3.03 | % | — | 140,052 | (9) | 140,052 | 3.09 | % | |||||||||||||||||||||

Anthony R. Vross | 2,000 | — | 2,000 | (2 | ) | 3,080 | — | 3,080 | (2 | ) | ||||||||||||||||||||||

Timothy K. Woofter | 2,723 | 79,791 | (9) | 82,514 | 1.82 | % | 4,631 | 128,735 | (10) | 133,366 | 2.95 | % | ||||||||||||||||||||

All directors and executive officers as a group (14 persons) | 333,611 | 7.37 | % | |||||||||||||||||||||||||||||

All directors and executive officers as a group (13 persons) | All directors and executive officers as a group (13 persons) |

| 383,759 | 8.48 | % | |||||||||||||||||||||||||||

| (1) | The “Percent of Class” computation is based upon the sum of |

| (2) | Represents beneficial ownership of less than 1% of the outstanding common shares of Cortland. |

| (3) | Individual named in the Summary Compensation Table under Executive Compensation. |

| (4) |

| Includes |

| These common shares are owned by Mr. Carney’s spouse. |

| Includes (a) |

| Includes |

| (8) | Includes 8,208 common shares held in Mr. Lucido’s 401(k) plan account. |

| (9) | These common shares are held in a trust of which Mr. Thompson is the trustee. |

| (10) | Includes (a) |

Stock Ownership Guidelines. At its May 22, 2012 meeting, the Board adopted stock ownership guidelines for directors, affirming the value that the Board places on directors having a significant personal financial stake in our success and the value that the Board places on the alignment of the interests of directors with the interests of stockholders generally. A director who does not comply with the guidelines will not be nominated for election. If the value of the director’s holdings declines to an amount under the minimum, the director’s annual retainer will be applied toward the purchase of shares, rather than being paid to the director in cash. The minimum value of a nonemployee director’s holdings of our stock is twice the annual retainer paid to directors, which currently is $18,000. For employee directors, the minimum value is four times the annual retainer. Directors are expected to achieve compliance with the stock ownership guidelines within three years after becoming a director or within three years after the May 2012 adoption of the guidelines.

RECORD DATE AND OUTSTANDING SHARES; QUORUM

If you were a shareholder of Cortland at the close of business on April 10, 2013,14, 2014, you are entitled to vote at the Annual Meeting. As of April 10, 2013,14, 2014, there were 4,527,8514,527,848 common shares of Cortland issued and outstanding. When present in person or by proxy at the Annual Meeting, the holders of a majority of the common shares of Cortland issued and outstanding and entitled to vote will constitute a quorum for the conduct of business at the Annual Meeting.

Shareholders are entitled to one vote for each share held. Shareholders are not entitled to cumulate their votes in the election or removal of directors or otherwise. The director nominees receiving the greatest numbers of votes will be elected. The result ofWe will consider the non-binding vote onproposal regarding executive compensation willto be taken into consideration byapproved if the Board in future executive compensation arrangements. The non-binding frequency withproposal receives the greatest numbers of votes will be considered for future advisory votes on executive compensation. The affirmative vote of a majority of votes cast. The proposal to amend the issued andCode of Regulations will be considered adopted if it receives the affirmative vote of the holders of shares entitled to exercise a majority of the voting power of the outstanding shares of our common shares is needed to ratify the appointment of S.R. Snodgrass, A.C. as Cortland’s independent auditor for 2013.stock.

ABSTENTIONS AND BROKER NON-VOTES

Abstention may be specified on all proposals except the election of directors. Broker non-votes generally occur when shares held by a broker nominee for a beneficial owner are not voted with respect toon a proposal because the nominee has not received voting instructions from the beneficial owner and lacks discretionary authority to vote the shares. Brokers normallygenerally have discretionthe right to vote on “routine matters,”a proposal such as the ratification of the selection of independent registered public accounting firms,auditors, but brokers generally do not have the discretion to vote on non-routine matters such as amendments to charter documents, executive compensation proposals, and the election of directors. Although abstentionsAbstentions and broker non-votes will be counted for purposes of establishing that a quorum is present, abstentionspresent. Abstentions and broker non-votes will have no effect on the election of directors. Broker non-votesdirectors or on the non-binding proposal to approve executive compensation. Because the proposal to amend the Code of Regulations will likewise have no impact on anynot be approved unless it receives the affirmative vote of holders of shares entitled to exercise a majority of the other proposals, butvoting power of all outstanding shares, abstentions and broker non-votes will have the same effect as votes against.against the proposal to amend the Code of Regulations.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the Exchange Act), requires Cortland’s executive officers and directors to file reports with the Securities and Exchange Commission (SEC) disclosing their initial beneficial ownership of common shares and any subsequent changes in their beneficial ownership. Specific due dates have been established by the SEC, and Cortland is required to disclose in this proxy statement any late reports. To Cortland’s knowledge, based solely on a review of reports furnished to Cortland and written representations that no other reports were required, Cortland’s executive officers and directors complied with all Section 16(a) filing requirements during the 20122013 fiscal year.year, except that in June of 2013 Mr. Neil Kaback filed a Form 4 one week late, reporting the purchase of 1,000 shares of Cortland stock. In January of 2014, Mr. Lance Morrison filed a Form 4 two weeks late, reporting the purchase of 49 shares of Cortland stock. Until the shares were included in a Form 4 filing made by Mr. Timothy Woofter on January 29, 2014, since May of 2000 48,936 shares beneficially owned through his interest in a family trust have not been included in Mr. Woofter’s total beneficial share ownership.

(Proposal One)

As of the date of this proxy statement, theThe Board currently has eleven (11) members. Directors are divided into three classes, and directors of each class serve for three-year terms. ThreeFour directors serve in the class whose terms will expire at the Annual Meeting, four directors serve in the class whose term expires in 20142015 and fourthree directors serve in the class whose term expires in 2015.2016. Proxies may not be voted for more than the threefour nominees.

Directors are individuals with knowledge and experience who serve and represent Cortland’s geographic footprint throughout the counties and communities served and those counties contiguous to its market. Current Board representation by outside directors demonstrates a background in automotive, law, manufacturing, and the accounting industries, with the expertise of these individuals covering a broad array of skills including corporate management, human resource management, strategic planning, business acquisitions, and small business operations.

The Board proposes that the threefour nominees identified be elected for a new term of three years. Each nominee was recommended by the Board’s Corporate Governance Committee. Each individual elected as a director at the Annual Meeting will hold office until his term expires and thereafter until his successor is duly elected and qualified, or until his earlier resignation, removal from office, or death. While it is contemplated that all nominees will stand for re-election, if a nominee who would otherwise receive the required number of votes becomes unavailable or unable to serve as a candidate for re-election as a director, the individuals designated as proxies on the proxy card will have full discretion to vote the common shares represented by the proxies they hold for the election of the remaining nominees and for the election of any substitute nominee or nominees designated by the Board following recommendation by the Corporate Governance Committee. The Board knows of no reason why any of the nominees named below will be unavailable or unable to serve if elected to the Board.

The biographies of each of the nominees and continuing directors below contain information regarding the person’s service as a director, business experience, director positions held currently or at any time during the last five years, information regarding involvement in certain legal or administrative proceedings, if applicable, and the experiences, qualifications, attributes, or skills that caused the Corporate Governance Committee and the Board to determine that the person should serve as a Cortland director.

Nominee | Age | Biography | Director of | Nominee for Term | ||||

| David C. Cole | 55 | Mr. Cole is a Partner and President of Cole Valley Motor Company, an automobile dealership. He is President of JDT, Inc., Cole Valley Chevrolet, CJB Properties, and David Tom LTD, automobile sales, since 2001. As President of a family-owned automobile dealership located in Warren, Ohio, Mr. Cole is responsible for the management and day-to-day operations of the business. He has a Bachelor of Science degree in business administration. Mr. Cole serves on the board of Forum Health. The Corporate Governance Committee and the Board believe that Mr. Cole’s experiences, qualifications, attributes and skills allow him to provide an extensive understanding of small business and retail needs. | 1989 | 2017 | ||||

| Timothy Carney | 48 | Mr. Carney is Executive Vice President and Chief Operating Officer of the Company and the Bank as well as Secretary of the Company and the Bank since November 2, 2009. He was previously Senior Vice President and Chief Operations Officer of the Company and the Bank. Prior to joining the bank, Mr. Carney was employed by a major accounting firm and had experience in all financial activities and financial reporting, audit preparation, budgeting, and knowledge of government regulatory requirements. The Corporate Governance Committee and the Board believe that the experiences, qualifications, attributes and skills that Mr. Carney has developed allow him to provide valuable accounting, strategic planning and corporate governance expertise to the Board. | 2009 | 2017 | ||||

Nominee | Age | Biography | Director of Cortland Since | Nominee for Term Expiring In | ||||||||

James M. Gasior | 53 | Mr. Gasior is the President, Chief Executive Officer and Director of the Company and the Bank. He is also a director of CSB Mortgage Company, Inc. He previously served as Senior Vice President, Chief Financial Officer and Secretary of the Company and the Bank. Mr. Gasior is a Certified Public Accountant, a member of the American Institute of CPAs and a member of the Ohio Society of CPAs. His professional affiliation includes a background in all financial activities and financial reporting, audit preparation, budgeting, compensation reviews, and knowledge of government regulatory requirements. The Corporate Governance Committee and the Board believe that the experiences, qualifications, attributes and skills that Mr. Gasior has developed allow him to provide valuable accounting, strategic planning and corporate governance expertise to the Board. | 2005 | 2016 | ||||||||

Nominee Age Biography Richard B. Thompson Joseph P. Langhenry Nominee Age Biography Director of Nominee for Term Director of

Cortland

Since Nominee for

Term

Expiring In 64 Mr. Thompson is the owner and executive of Therm-O-Link, Inc., Vulkor, Inc., and Therm-O-Link of Texas, Inc., all manufacturers of electrical wire and cable; Owner and executive of Geneva Partners, a condominium development company which is no longer active; Executive of Kinsman IGA, a grocery store; Partner in Dana Partners, a real estate holding company, and Dana Gas, a gas well operation; Owner of the Heritage Hill Grain Company and Heritage Hill Enterprises, agricultural businesses, since 2003; Partner in Stratton Creek Woodworks, a maker of wood products, and Smearcase, a real estate holding company, each since 2005; Partner in Goodview, a Brazilian agricultural business; and Partner in Kinsman Hardware LLC, a home improvement store. Mr. Thompson is a private investor with an extensive background in manufacturing. The Corporate Governance Committee and the Board believe that Mr. Thompson’s experiences, qualifications, attributes and skills allow him to provide assistance in understanding and evaluating manufacturing business relationships. He has owned and managed numerous small businesses in several industries in the Bank’s current market area, as well as outside the immediate area. 2001 2016 54 Mr. Langhenry is the President and CEO of Watteredge, Inc., since 2000. A division of Coleman Cable, Inc., Watteredge, Inc. is a Cleveland-area manufacturer of power connectors and other products for the power generation, automotive and other industries. Mr. Langhenry started with Watteredge as a Sales Manager and previously worked as a bond trader for Prescott Ball and Turbin. He serves on the Board of the Lakewood Country Club. The Corporate Governance Committee and the Board believe that Mr. Langhenry’s experiences, qualifications, attributes and skills allow him to provide valuable business leadership expertise to the Board. — 2016

Cortland

Since

Expiring InNeil J. Kaback 53 Mr. Kaback is Vice President of Cohen & Company, Inc., a firm that provides marketing for Cohen & Company LTD (an accounting firm where Mr. Kaback is also a Vice President). Mr. Kaback is a partner in Cohen & Company Investment Partnership, a financial planning firm and Vice President of Cohen Fund Audit Services, a mutual fund auditing firm. He is a member of the American Institute of CPAs and the Ohio Society of CPAs. Mr. Kaback has varied responsibilities. He focuses on high level business succession, tax, estate, and family business planning, as well as the supervision and planning of financial statement and tax return engagements. He heads the firm’s Automotive Dealers Group and provides managerial, operational, financing, and tax consulting advice. Mr. Kaback serves as Finance Chairman for the Trumbull Memorial Hospital Foundation and was the Campaign Chairman of Operation: Save our Airbase Reservists. He is also a director of GOJO, Inc. He was a member of the Leadership Youngstown Class of 92-93, and is actively involved with the Mahoning County United Way, Trumbull 100 and Youngstown Area Jewish Federation. The Corporate Governance Committee and the Board believes that the experiences, qualifications, attributes and skills that Mr. Kaback has developed allow him to provide continued accounting and financial expertise to the Board. 2004 2017 Anthony R. Vross 52 Mr. Vross is an owner of Simon Roofing and has 29 years of experience in executive administration, manufacturing, operations, distribution and sales and marketing. He has a Bachelors of Science in Business Administration degree from Youngstown State University. He is the inventor of the Fume Recovery System and is involved in many other concepts and technology in the roofing industry. Mr. Vross sponsors his company’s membership in the National Roofing Contractors Association and Restaurant Facilities Management Association and was a speaker for Professional Retail Store Management. He is a Trustee and president of Glacier Sports, Inc. He is a member of St. Maron’s parish where he has been a parish council member, CCD teacher and volunteer for the Maronite Youth organization. The Corporate Governance Committee and the Board believes that the experiences, qualifications, attributes and skills that Mr. Vross has developed through his business and industry experiences allow him to provide local business expertise and innovation insight to the Board. 2013 2017

Recommendation and Vote

Under Ohio law and Cortland’s Code of Regulations, the nominees receiving the greatest number of votes“FOR” election will be elected to the Board. Shareholders are not entitled to cumulate votes in the election of directors. Common shares represented by properly executed and returned proxy cards will be voted“FOR”the election of the Board’s nominees named above unless authority to vote for one or more nominees is withheld. Common shares as to which the authority to vote is withheld and broker non-votes will be counted for quorum purposes, but will not be counted towardin the election of directors or toward the election of the individual nominees specified on the proxy card.directors.

The Board recommends a voteFOR the election of the nominees.

Nominee | Age | Biography | Director of Cortland Since | Term Expires In | Age | Biography | Director of | Term | ||||||||||||

David C. Cole | 54 | Mr. Cole is a Partner and President of Cole Valley Motor Company, an automobile dealership. He is President of JDT, Inc., Cole Valley Chevrolet, CJB Properties, and David Tom LTD, automobile sales, since 2001. As President of a family-owned automobile dealership located in Warren, Ohio, Mr. Cole is responsible for the management and day-to-day operations of the business. He has a Bachelor of Science | 1989 | 2014 | ||||||||||||||||

| George E. Gessner | 69 | An attorney, Mr. Gessner is Partner, Director, and Corporate Secretary in the law firm of Gessner & Platt Co., L.P.A. Mr. Gessner has been a general practitioner of law for over 40 years and is a partner in the local law firm. He received his undergraduate (B.A.) degree at Hiram College and his Juris Doctorate (J.D.) degree from the University of Akron Law School. He became a member of the Ohio Bar in 1969. The Corporate Governance Committee and the Board believe that Mr. Gessner’s background as a lawyer and his experiences, qualifications, attributes and skills allow him to provide valuable insights to the Board. | 1987 | 2015 | ||||||||||||||||

| James E. Hoffman, III | 62 | An attorney, Mr. Hoffman is President of Hoffman & Walker Co., L.P.A. Mr. Hoffman has been a general practitioner of law for over 37 years and is a partner in a local law firm. He received his undergraduate (B.A.) degree at The Ohio State University in 1973 and his Juris Doctorate (J.D.) degree from the University of Akron Law School in 1976. The Corporate Governance Committee and the Board believe that Mr. Hoffman’s background as a lawyer and his experiences, qualifications, attributes and skills allow him to provide valuable insights to the Board. | 1984 | 2015 | ||||||||||||||||

| Joseph E. Koch | 56 | Mr. Koch is President of Joe Koch Construction, Inc., a homebuilding, developing and remodeling company since 1988. He is also President of Joe Koch Realty, Inc., a real estate brokerage firm, and owner of Better Living of the Mahoning Valley, a dealer for sunrooms and installations. Mr. Koch is a member of Eagle Ridge Properties, LLC since 2002. He is the President of Koch Family Charitable Foundation, a 501(c)3 organization. The Corporate Governance Committee and the Board believe that Mr. Koch’s experiences, qualifications, attributes and skills allow him to provide local business expertise to the Board. | 2010 | 2015 | ||||||||||||||||

| Timothy K. Woofter | 63 | Mr. Woofter is President, CEO, and Director of Stanwade Metal Products, a manufacturer of tanks and distributor of oil equipment, and Lucky Oil Equipment, a distributor of oil equipment. He is Partner in the Woofter Family Limited Partnership; Owner, Jester Investments, a residential and commercial property rental company; Part owner and Vice President of Northern Ventures, a real estate rental company; Manager of Hartford Land LLC, a Real Estate Holding Company; and Director of the Trade Association, Steel Tank Institute. Mr. Woofter has managed and owned a business that manufactures steel storage tanks and distributes oil-handling equipment for 40 years. He has owned and managed real estate, both residential and commercial, for over 30 years and is familiar with properties of these types and their values. The Corporate Governance Committee and the Board believe that the experiences, qualifications, attributes and skills that Mr. Woofter has developed through his business and leadership experiences allow him to provide business and leadership insight to the Board. | 1985 | 2015 | ||||||||||||||||

Nominee Age Biography Timothy Carney Neil J. Kaback Anthony R. Vross Director of

Cortland

Since Term

Expires In degree in business administration. Mr. Cole serves on the board of Forum Health. The Corporate Governance Committee and the Board believe that Mr. Cole’s experiences, qualifications, attributes and skills allow him to provide an extensive understanding of small business and retail needs. 47 Mr. Carney is Executive Vice President and Chief Operating Officer of the Company and the Bank as well as Secretary of the Company and the Bank since November 2, 2009. He was previously Senior Vice President and Chief Operations Officer of the Company and the Bank. Prior to joining the bank, Mr. Carney was employed by a major accounting firm and had experience in all financial activities and financial reporting, audit preparation, budgeting, and knowledge of government regulatory requirements. The Corporate Governance Committee and the Board believe that the experiences, qualifications, attributes and skills that Mr. Carney has developed allow him to provide valuable accounting, strategic planning and corporate governance expertise to the Board. 2009 2014 52 Mr. Kaback is Vice President of Cohen & Company, Inc., a firm that provides marketing for Cohen & Company LTD (an accounting firm where Mr. Kaback is also a Vice President). Mr. Kaback is a partner in Cohen & Company Investment Partnership, a financial planning firm and Vice President of Cohen Fund Audit Services, a mutual fund auditing firm. A member of the American Institute of CPAs and the Ohio Society of CPAs, Mr. Kaback has varied responsibilities. He focuses on high level business succession, tax, estate, and family business planning, as well as the supervision and planning of financial statement and tax return engagements. He heads the firm’s Automotive Dealers Group and provides managerial, operational, financing, and tax consulting advice. He serves as Finance Chairman for the Trumbull Memorial Hospital Foundation and was the Campaign Chairman of Operation: Save our Airbase Reservists. The Corporate Governance Committee and the Board believe that the experiences, qualifications, attributes and skills that Mr. Kaback has developed allow him to provide continued accounting and financial expertise to the Board. 2004 2014 51 Mr. Vross is owner of Simon Roofing and has 28 years of experience in executive administration, manufacturing, operations, distributions and sales and marketing. He is the inventor of the Fume Recovery System, which is utilized nationwide by such facilities as schools, food processing plants, hospitals and other odor-sensitive environments, and is involved in many other concepts and technology in the roofing industry. Mr. Vross sponsors his company’s membership in the National Roofing Contractors Association and Restaurant Facilities Management Association and is a speaker for Professional Retail Store Management. He is a trustee and president of Glacier Sports, Inc. The Corporate Governance Committee and the Board believe that the experiences, qualifications, attributes and skills that Mr. Vross has developed through his business and industry experiences allow him to provide local business expertise and innovation insight to the Board. 2013 2014

Nominee Age Biography George E. Gessner An attorney, Mr. Gessner is Partner, Director, and Corporate Secretary in the law firm of Gessner & Platt Co., L.P.A. Mr. Gessner has been a general practitioner of law for over 40 years and is a partner in a local law firm. He received his undergraduate (B.A.) degree at Hiram College and his Juris Doctorate (J.D.) degree from the University of Akron Law School. He became a member of the Ohio Bar in 1969. The Corporate Governance Committee and the Board believe that Mr. Gessner’s experiences, qualifications, attributes and skills allow him to provide legal expertise to the Board. Mr. Gessner is also a Director of CSB Mortgage Company, Inc. James E. Hoffman, III An attorney, Mr. Hoffman is President of Hoffman & Walker Co., L.P.A. Mr. Hoffman has been a general practitioner of law for over 36 years and is a partner in a local law firm. He received his undergraduate (B.A.) degree at The Ohio State University in 1973 and his Juris Doctorate (J.D.) degree from the University of Akron Law School in 1976. The Corporate Governance Committee and the Board believe that Mr. Hoffman’s experiences, qualifications, attributes and skills allow him to provide legal expertise to the Board. Mr. Hoffman is also a Director of CSB Mortgage Company, Inc. Joseph E. Koch Mr. Koch is President of Joe Koch Construction, Inc., a homebuilding, developing and remodeling company since 1988. He is also President of Joe Koch Realty, Inc., a real estate brokerage firm, and owner of Better Living of the Mahoning Valley, a dealer for sunrooms and installations. Mr. Koch is a member of Eagle Ridge Properties, LLC since 2002. He is the President of Koch Family Charitable Foundation, a 501(c)3 organization. The Corporate Governance Committee and the Board believe that Mr. Koch’s experiences, qualifications, attributes and skills allow him to provide local business expertise to the Board. Mr. Koch is also a Director of CSB Mortgage Company, Inc. Timothy K. Woofter Director of

Cortland

Since Term

Expires In 68 1987 2015 61 1984 2015 55 2010 2015 62 Mr. Woofter is President, CEO, and Director of Stanwade Metal Products, a manufacturer of tanks and distributor of oil equipment, and Lucky Oil Equipment, a distributor of oil equipment. He is Partner in the Woofter Family Limited Partnership; Owner, Jester Investments, a residential and commercial property rental company; Part owner and Vice President of Northern Ventures, a real estate rental company; Manager of Hartford Land LLC, a Real Estate Holding Company; and Director of the Trade Association, Steel Tank Institute. Mr. Woofter has managed and owned a business that manufactures steel storage tanks and distributes oil-handling equipment for 40 years. He has owned and managed real estate, both residential and commercial, for over 30 years and is familiar with properties of these types and their values. The Corporate Governance Committee and the Board believe that the experiences, qualifications, attributes and skills that Mr. Woofter has developed through his business and leadership experiences allow him to provide business and leadership insight to the Board. 1985 2015

Nominee Age Biography Director of Term

Cortland

Since

Expires InJames M. Gasior 54 Mr. Gasior is the President, Chief Executive Officer and Director of the Company and the Bank. He previously served as Senior Vice President, Chief Financial Officer and Secretary of the Company and the Bank. Mr. Gasior is a Certified Public Accountant, a member of the American Institute of CPAs and a member of the Ohio Society of CPAs. His professional affiliation includes a background in all financial activities and financial reporting, audit preparation, budgeting, compensation reviews, and knowledge of government regulatory requirements. The Corporate Governance Committee and the Board believe that the experiences, qualifications, attributes and skills that Mr. Gasior has developed allow him to provide valuable accounting, strategic planning and corporate governance expertise to the Board. 2005 2016 Richard B. Thompson 65 Mr. Thompson is the owner and executive of Therm-O-Link, Inc., Vulkor, Inc., and Therm-O-Link of Texas, Inc., all manufacturers of electrical wire and cable; Owner and executive of Geneva Partners, a condominium development company which is no longer active; Executive of Kinsman IGA, a grocery store; Partner in Dana Partners, a real estate holding company, and Dana Gas, a gas well operation; Owner of the Heritage Hill Grain Company and Heritage Hill Enterprises, agricultural businesses, since 2003; Partner in Stratton Creek Woodworks, a maker of wood products, and Smearcase, a real estate holding company, each since 2005; Partner in Goodview, a Brazilian agricultural business; and Partner in Kinsman Hardware LLC, a home improvement store. Mr. Thompson is a private investor with an extensive background in manufacturing. The Corporate Governance Committee and the Board believe that Mr. Thompson’s experiences, qualifications, attributes and skills allow him to provide assistance in understanding and evaluating manufacturing business relationships. He has owned and managed numerous small businesses in several industries in the Bank’s current market area, as well as outside the immediate area. 2001 2016 Joseph P. Langhenry 55 Mr. Langhenry is the President and CEO of Watteredge, Inc., since 2000. A division of Coleman Cable, Inc., Watteredge, Inc. is a Cleveland-area manufacturer of power connectors and other products for the power generation, automotive and other industries. Mr. Langhenry started with Watteredge as a Sales Manager and previously worked as a bond trader for Prescott Ball and Turben. He serves on the Board of the Lakewood Country Club. The Corporate Governance Committee and the Board believe that Mr. Langhenry’s experiences, qualifications, attributes and skills allow him to provide valuable business leadership expertise to the Board. 2013 2016

THE BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD

Independence of Directors

The Board has reviewed, considered, and discussed each director’s relationships, both direct or indirect, with Cortland and its subsidiaries and the compensation and other payments, if any, each director has, both directly or indirectly, received from or made to Cortland and its subsidiaries in order to determine whether suchthe director qualifies as independent under Rule 5605(a)(2) of Nasdaq’s Marketplace Rules.is independent. The Board has determined that it has at least a majority of independent directors and that each of the following directors has no financial or personal ties, either directly or indirectly, with Cortland or its subsidiaries (other than compensation as a director of Cortland and its subsidiaries, banking relationships in the ordinary course of business with the Bank, and ownership of Cortland’s common shares as described in this proxy statement) and thus qualifies as independent under Nasdaq Corporate Governance Rule 5605(a)(2): Jerry A. Carleton, David C. Cole, George E. Gessner, James E. Hoffman, III, Neil J. Kaback, Joseph E. Koch, Joseph P. Langhenry, Richard B. Thompson, Anthony R. Vross, and Timothy K. Woofter. Joseph P. Langhenry, a nominee presented in this proxy statement, also qualifies as independent under the NASDAQ rules.

James M. Gasior and Timothy Carney do not qualify as independent directors because they currently serve as executive officers of Cortland and its subsidiaries.

Meetings of the Board and Attendance at the Annual Meeting of Shareholders

In 2012,2013, the Board held a total of twelve (12)18 meetings. Each incumbent director attended at least 75% of the aggregate of the total number of meetings held by the Board and the total number of meetings held by the board committees on which he served, in each case during the period of his service.

Cortland encourages all incumbent directors and director nominees to attend each annual meeting of shareholders. All of the incumbent directors and director nominees attended Cortland’s last Annual Meeting of Shareholders, held on May 22, 2012 with the exception of Mr. Vross, who was appointed to the Board on January 1, 2013, and Mr. Langhenry, who is a nominee for election at the 2013 Annual Meeting.28, 2013.

Communications with the Board

Although Cortland does not currently have formal procedures by which shareholders may communicate directly with directors, Cortland believes that its current process has adequately served the needs of the Board and its shareholders. Communications sent to the Board, either generally or in care of the Chief Executive Officer, Secretary, the Investor Relations Officer, or another corporate officer, are forwarded to all directors. There is no screening process, and all communications that are received by officers for the Board’s attention are forwarded to the Board.

Until other procedures are developed and posted on Cortland’s website at www.cortland-banks.com, any communication to the Board may be mailed to the Board, in care of the Investor Relations Officer, at Cortland’s headquarters in Cortland, Ohio. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Shareholder-Board Communication” or a “Shareholder-Director Communication.” In addition, communication via Cortland’s website may be used. Correspondence through the investor relations page of the website should also be directed to the Investor Relations Officer and indicate that the communication is a “Shareholder-Board Communication” or a “Shareholder-Director Communication.” All such communications, whether via mail or website, must identify the author as a shareholder and clearly state whether the intended recipients are all directors on the Board or just certain specified individual directors or committee members. The Investor Relations Officer will make copies of all such communications and circulate them to the appropriate director or directors.

Board Committees

Audit Committee

The Board has an Audit Committee comprised of Messrs. Cole, Kaback (Chair), Thompson and Thompson.Vross. The Board has determined that each member of the Audit Committee qualifies as independent under the Nasdaq Marketplace Rules, as well as under Rule 10A-3 promulgated under the Exchange Act. The Board has determined that Mr. Kaback qualifies as an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K. Mr. Kaback has acquired these attributes through education and experience as a certified public accountant. Mr. Vross became a member of the Audit Committee in January 2013.

The Audit Committee conducts its business pursuant to a written charter adopted by the Board. A current copy of the charter of the Audit Committee is posted on Cortland’s website at www.cortland-banks.com on the investor relations page under Governance Documents, “Audit Committee Charter.” At least annually, the Audit Committee reviews and reassesses the adequacy of its charter and recommends any proposed changes to the full Board for approval as necessary.

The Audit Committee is responsible for appointing, compensating, and overseeing the independent registered public accounting firm employed by Cortland for the purpose of preparing and issuing an audit report or other audit, review, or attestation services. The Audit Committee evaluates the independence of the independent registered public accounting firm on an ongoing basis. The Audit Committee also approves audit reports and plans, accounting policies, and audit outsource arrangements, including audit scope, internal audit reports, audit fees, and certain other expenses. The Audit Committee is responsible for developing procedures for the receipt, retention, and treatment of complaints regarding accounting, internal auditing controls, or auditing matters, including procedures for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

The Audit Committee held six (6) meetings during 2012.in 2013. The Audit Committee’s report relating to the 20122013 fiscal year appears on page 18 ofelsewhere in this proxy statement.

Corporate GovernanceCompensation Committee

Effective May 22, 2012, the Board of Directors merged the ExecutiveThe Compensation Committee and the Nominating Committee into the Corporate Governance Committee, which in the aggregate performs the same functions as the committees did individually. The Corporate Governance Committee is comprised of Messrs. Carleton, Carney, Cole, Gasior, Gessner, Thompson and Woofter (Chair). The Board has determined that each non-employee member of the Corporate Governance Committee qualifies as independent under Nasdaq Marketplace Rules. In addition, each non-employee member of the Corporate Governance Committee qualifies as an “outside director” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended (the IRC), and as a “non-employee director” for purposes of Section 16b-3 under the Exchange Act. The Corporate Governance Committee held five (5) meetings during 2012.

Executive Compensation Committee

Through May 21, 2012, the Board of Directors had an Executive Compensation Committee which also served as the Compensation Committee of Cortland. This Committee has since combined with the Corporate Governance Committee. The Executive Compensation Committee was comprised of Messrs. Carleton, Gessner, and Woofter (Chair). The Board determined that each member of the Executive Compensation Committee qualified as independent under Nasdaq Marketplace Rules. In addition, each member of the Compensation Committee qualified as an “outside director” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended (the IRC), and as a “non-employee director” for purposes of Section 16b-3 under the Exchange Act.

The Executive Compensation Committee oversees director and executive officer compensation as well as compensation under the Profit Sharing Program and the Employee Benefit Plan 401(k). The Executive Compensation Committee reviews and recommends officer compensation levels and benefit plans. In evaluating executive officer performance, the Executive Compensation Committee takes into account –

job knowledge, initiative, and originality;

quality and accuracy of work performed and priority setting;

customer relations;

subordinate feedback and ability to provide instruction to staff; and

the relationship of these factors to Cortland and the Bank’s achievement of strategic objectives and profitability.

The Executive Compensation Committee occasionally requests the Chief Executive Officer (CEO) to be present at Executive Compensation Committee meetings to discuss executive compensation and evaluate individual performance. The Executive Compensation Committee discusses the CEO’s compensation with him, but final deliberations and all votes regarding his compensation are made in executive session, without the CEO present. The Executive Compensation Committee also approves the compensation for other executive officers based on the CEO’s recommendations with input from outside advisors and counsel and then makes its recommendation to the Board.

The Executive Compensation Committee reviews publicly available peer data to assist with evaluating the overall compensation for the Board. From time to time, the Executive Compensation Committee will recommend changes in compensation to further the goals of the director compensation program, which strives to provide appropriate compensation to directors for their time, efforts and contributions.

The Executive Compensation Committee uses compensation data from similar-sized financial institutions for comparative purposes from time to time to provide input on both Board and executive compensation issues, but it did not engage a consultant in setting 20122013 compensation. The Executive Compensation Committee does not have a formal charter. The Executive Compensation Committee held two (2) meetingsone (1) meeting in 2012.2013.

NominatingCorporate Governance Committee

Through May 21, 2012, the Board had a NominatingThe Corporate Governance Committee is comprised of Messrs. Cole, Gessner, Thompson, and Woofter (Chair). This Committee has since combined with the Corporate Governance Committee. The Board has determined that each member of the NominatingCorporate Governance Committee qualifiedqualifies as independent under Nasdaq Marketplace Rules. The purposeIn addition, each member of the NominatingCorporate Governance Committee qualifies as an “outside director” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended (the IRC), and as a “non-employee director” for purposes of Section 16b-3 under the Exchange Act. The Corporate Governance Committee held one (1) meeting during 2013. The charter of the Corporate Governance Committee is to:reviewed annually and is available on Cortland’s website at www.cortland-banks.com on the investor relations page under Governance Documents, “Nominating and Corporate Governance Committee Charter.”

The Corporate Governance Committee is charged with the following responsibilities:

identify qualified candidates for election, nomination, or appointment to the Board and recommend to the full Board a slate of director nominees for each annual meeting or as vacancies occur;

make recommendations to the full Board and the Chairman of the Board regarding assignment and rotation of members and chairs of committees of the Board;

recommend the number of directors to serve on the Board; and

undertake such other responsibilities as may be referred to the NominatingCorporate Governance Committee by the full Board or the Chairman of the Board.

The Nominating Committee held one (1) meeting during 2012. The charter of the Nominating Committee is reviewed annually and is available on Cortland’s website at www.cortland-banks.com on the investor relations page under Governance Documents, “Nominating and Corporate Governance Committee Charter.”

Nominating Procedures

The Corporate Governance Committee has the responsibility to identify and recommend individuals qualified to become directors. Each candidate must satisfy the eligibility requirements set forth in Cortland’s Code of Regulations, Article Two, Section 2.01 “Authority and Qualifications.” No person who has attained the age of 70 shall beis eligible for election as a director, and each director must hold shares of stock of Cortland with an aggregate par value or stated value of $500, an aggregate shareholder equity of at least $500, or an aggregate fair market value of at least $500. The stock ownership guidelines adopted by the board in 2012 provide that the minimum stock ownership level for nonemployee directors is shares having a value equal to two times the annual retainer, and the minimum stock ownership level for employee directors is shares having a value equal to four times the annual retainer.

When considering potential candidates for the Board, the Corporate Governance Committee strives to assure that the composition of the Board, as well as its practices and operation, contributes to an effective representation and advocacy of shareholders’ interest. The Corporate Governance Committee may consider those factors it deems appropriate in evaluating director candidates, including judgment, skill, strength of character, experience with business and organizations comparable in size and scope to Cortland, experience and skills relative to other Board members, and specialized knowledge or experience. Depending upon the current needs of the Board, certain factors may be weighed more heavily than others by the Corporate Governance Committee. The Corporate Governance Committee does not have a policy for the consideration of diversity in the nomination process, but takes into account in its deliberations all facets of a potential nominee’s background, including the potential nominee’s educational background, gender, business and professional experience, and his or her particular skills and other qualities. The Corporate Governance Committee’s goal is to identify individuals who will enhance and add valuable perspective to the Board’s deliberations and who will assist Cortland in its effort to capitalize on business opportunities in a challenging and highly competitive market.

In considering candidates for the Board, the Corporate Governance Committee evaluates the entirety of each candidate’s credentials and, other than the eligibility requirements set forth in Cortland’s Code of Regulations and other than the stock ownership guidelines, there are no specific minimum qualifications that must be met by a Corporate Governance Committee-recommended nominee. However, the Corporate Governance Committee does believe that each director on the Board should be of the highest character and integrity; possess a reputation for working constructively with others; have sufficient time to devote to Board matters; and be without any conflict of interest that would impede the individual’s performance as a director.

The Corporate Governance Committee will consider candidates for the Board from any reasonable source, including shareholder recommendations. The Corporate Governance Committee will not evaluate candidates differently based on who

has made the recommendation. The Corporate Governance Committee has the authority to hire and pay a fee to consultants or search firms for the purpose of identifying and evaluating candidates. No such consultants or search firms have been used to date and, accordingly, no fees have been paid to consultants, search firms, or any other individuals.

According to Section 2.03(B) of Cortland’s Code of Regulations, any shareholder who desires to nominate an individual to the Board must provide timely written notice. To be timely, the notice must be mailed to the President of Cortland at least 14 days but no more than 50 days before the meeting at which directors will be elected, or 7 days after notice of the meeting is mailed to shareholders if the meeting is held within 21 days of Cortland mailing notice of the meeting.

The shareholder’s notice of nomination must give:

the name and address of the nominee;

the principal occupation of the nominee;

the approximate number of shares the shareholder making the nomination reasonably anticipates will be voted in favor of the proposed nominee;

the name and address of the shareholder making the nomination; and

the number of shares beneficially owned by the shareholder making the nomination.

The Corporate Governance Committee will disregard a shareholder’s nomination if it is not made in compliance with these rules and standards.

Board Leadership Structure and Role in Risk Oversight

The office of Chairman of the Board and the office of Chief Executive Officer have been separate at Cortland since 2005. Since November 2, 2009, James M. Gasior has held the office of Chief Executive Officer and effective April 27, 2010, Timothy K. Woofter became Chairman of the Board. Cortland believes that separation of these two offices is consistent with the Board’s responsibility for oversight of management and of Cortland’s affairs generally. The Board and its committees have a significant role in oversight of the risks to which Cortland is subject. Like other community banking organizations, we exercise oversight of common banking risks through a loan committee that considers loan applications and credit risk, an asset and liability committee whose routine responsibilities require consideration of interest rate and liquidity risk, an audit committee that takes into account audit and regulatory compliance risks and a loan review committee that monitors non-performing assets and their ultimate outcome. The full Board, of course, takes these and other risks into account in its deliberations as well.

Code of Ethics

Cortland has adopted a Code of Ethics (the Code) as part of its corporate governance program. The Code applies to all of Cortland’s officers and employees, including its Chief Executive Officer and Chief Financial Officer. The Code is posted on the Investor Relations page of Cortland’s website at www.cortland-banks.com under Governance Documents, “Code of Business Conduct and Ethics.” Any amendments to, or waivers from, this Code will be posted on this same website. In addition, a copy of the Code is available to shareholders upon request. Shareholders desiring a copy of the Code should address written requests to Mr. Timothy Carney, Executive Vice President, Chief Operating Officer and Secretary of Cortland Bancorp, 194 West Main Street, Cortland, Ohio 44410, and are asked to mark “Code of Business Conduct and Ethics” on the outside of the envelope containing the request.

DIRECTOR COMPENSATION IN 20122013

The following table shows the compensation of Cortland directors for their service in 2012,2013, other than Directors Gasior and Carney. The director compensation information to follow represents compensation for the full year, through December 31, 2012. Compensation shown in the table is aggregate compensation paid for directors’ service both to Cortland and all of its subsidiaries. Information about compensation paid to and earned by Directors Gasior and Carney is included elsewhere in this proxy statement.the Summary Compensation Table. Compensation shown in the table is aggregate compensation paid in 2013 for directors’ service both to Cortland and all of its subsidiaries.

Name | Fees Earned or Paid in Cash ($) | All Other Compensation (1) ($) | Total ($) | Fees Earned or Paid in Cash ($) | All Other Compensation (1) ($) | Total ($) | ||||||||||||||||||

Jerry A. Carleton | 23,700 | 12,987 | 36,687 | |||||||||||||||||||||

Jerry A. Carleton (retired May 28, 2013) | 13,800 | 544 | 14,344 | |||||||||||||||||||||

David C. Cole | 25,000 | 5,317 | 30,317 | 30,600 | 6,096 | 36,696 | ||||||||||||||||||

George E. Gessner | 22,800 | 1,336 | 24,136 | 30,400 | 3,243 | 33,643 | ||||||||||||||||||

James E. Hoffman, III | 21,250 | 10,378 | 31,628 | 29,550 | 7,929 | 37,479 | ||||||||||||||||||

Neil J. Kaback | 23,050 | 2,879 | 25,929 | 32,200 | 3,340 | 35,540 | ||||||||||||||||||

Joseph E. Koch | 23,500 | 3,302 | 26,802 | 33,050 | 3,810 | 36,860 | ||||||||||||||||||

Joseph P. Langhenry (elected May 28, 2013) | 17,500 | — | 17,500 | |||||||||||||||||||||

Richard B. Thompson | 24,600 | 5,868 | 30,468 | 31,100 | 6,728 | 37,828 | ||||||||||||||||||

Anthony R. Vross | 31,700 | — | 31,700 | |||||||||||||||||||||

Timothy K. Woofter | 27,075 | 10,585 | 37,660 | 34,275 | 6,577 | 40,852 | ||||||||||||||||||

| (1) | Perquisites and other personal benefits provided to each of the directors described in the table were less than $10,000 in |

Retirement Agreements and Insurance for Non-Employee Directors. Directors Carleton, Cole, Gessner, Hoffman, Kaback, Thompson, and Woofter are parties to director retirement agreements with Cortland dating from December 2007.Cortland. The director retirement agreements promise a post-retirement benefit of $10,000 payable annually for 10 years if the director retires after reaching his normal retirement age, which is a function of years of service on the Board and attained age. Normal retirement ages for these directors are age 61 (Mr. Cole), age 62 (Mr. Hoffman), age 63 (Mr. Woofter), age 66 (Mr. Gessner), age 67 (Mr. Kaback), and age 70 (Messrs. Carleton and(Mr. Thompson). A reduced annual retirement benefit is payable if the director terminates service or becomes disabled before reaching the normal retirement age, but the benefit is not paid until the director reaches the normal retirement age. Having attained normal retirement age under his agreement, Mr. Carleton retired in 2013. If termination of the director’s service occurs within one year after a change in control of Cortland, the director will receive cash in a single lump sum equal to the retirement benefit expense accrued by Cortland. The director retirement agreement benefits to which a director is entitled are payable to his beneficiary after the director’s death, but if the director dies in active service to Cortland before reaching his normal retirement age, his beneficiary will be entitled to cash in a single lump sum equal to the retirement benefit expense accrued by Cortland.

Cortland purchased insurance on the lives of directors who are parties to the director retirement agreements and entered into split dollar agreements with them, promising to share a portion of the life insurance death benefits with the directors’ designated beneficiaries. Each director’s portion of the policy’s death benefit is $100,000, payable to the director’s beneficiary whether the director’s death occurs while in active service to Cortland or after retirement. Cortland will receive any death benefits remaining after payment to the director’s beneficiary.

Director Indemnification. At the 2005 Annual Meeting, the shareholders of Cortland approved the form and use of indemnification agreements with directors. On May 24, 2005, Cortland has entered into indemnification agreements with each of the current directors, other than Directors Koch and Vross. Director Koch entered into an indemnification agreement with

Cortland in May 2010 and Director Vross only recently joined the Board on January 1, 2013.its directors. The indemnification agreements allow a director to select the most favorable indemnification rights provided under:

Cortland’s Articles of Incorporation or Code of Regulations in effect on the date of the indemnification agreement or on the date expenses are incurred;

state law in effect on the date of the indemnification agreement or on the date expenses are incurred;

any liability insurance policy in effect when a claim is made against the director or on the date expenses are incurred; and

any other indemnification arrangement otherwise available.

The indemnification agreements cover all fees, expenses, judgments, fines, penalties, and settlement amounts paid in any matter relating to the director’s role as director, officer, employee, agent, or when serving as Cortland’s representative with another entity. Each indemnification agreement provides for the prompt advancement of all expenses incurred in a proceeding, subject to the director’s obligation to repay those advances if it is determined later that the director is not entitled to indemnification.

Retainer and Fees. Currently, the Board and the Board of Directors of the Bank consist of the same individuals. Directors Koch, Gessner and Woofter are also directors of CSB Mortgage Company, Inc.

The annual retainer for the Chairman of the Board is $20,000, with $675 for each board meeting attended. The annual retainer for all other non-employee directors is $18,000, plus $600 for each board meeting attended. Non-employee directors also receive a fee for each committee meeting attended: $400 for the Audit Committee, $400 for the Corporate Governance Committee, and $250 for other committees. Directors of CSB Mortgage Company, Inc. receive $250 for attending each meeting of that company’s board. Directors of the Bank (both employee and non-employee) may also elect to participate in the Bank’s health care plans at substantially the same rates as all employees.

Director Emeritus Compensation. For up to ten years after retirement as a director, an emeritus director of the Bank is paid $600 for each meeting attended, for an annual compensation of $7,200, provided the director emeritus attends at least 75% of Board meetings. Emeritus directors are also entitled to continue participation in the Bank’s health care plan, although the former director is responsible for paying 100% of the Bank’s cost to maintain health care coverage. After the emeritus director’s death, his or her spouse may similarly maintain health care coverage, at the spouse’s cost. Emeritus directors participate in Board meetings, but are not entitled to vote on any matters coming before the Board. In October 2012, the Board elected to discontinue the director emeritus compensation program. There will be no new emeritus director participants in the program, although the former directors currently participating will continue to do so until the end of the ten-year term.

(Proposals Two and Three)

Cortland does not provide any monetary compensation directly to its executive officers. Instead, the executive officers of Cortland are paid by the Bank for services rendered in their capacity as executive officers of Cortland and the Bank.

Summary Compensation Table

Name and Principal Position | Year | Salary(1) ($) | All Other Compensation(2) ($) | Total ($) | ||||||||||||

James M. Gasior | 2012 | 226,710 | 80,684 | 307,394 | ||||||||||||

President and Chief Executive Officer of Cortland and the Bank | 2011 | 205,200 | 74,523 | 279,723 | ||||||||||||

Timothy Carney | 2012 | 214,170 | 62,847 | 277,017 | ||||||||||||

Executive Vice President and Chief Operating Officer of Cortland and the Bank | 2011 | 193,200 | 59,747 | 252,947 | ||||||||||||

Stanley P. Feret | 2012 | 148,625 | 70,218 | 218,843 | ||||||||||||

Senior Vice President and Chief Lending Officer of the Bank | 2011 | 145,000 | 64,928 | 209,928 | ||||||||||||

Name and Principal Position | Year | Salary(1) ($) | All Other Compensation(2) ($) | Total ($) | ||||||||||

James M. Gasior | 2013 | 224,910 | 89,493 | 314,403 | ||||||||||

President and Chief Executive Officer of Cortland and the Bank | 2012 | 226,710 | 80,684 | 307,394 | ||||||||||

Timothy Carney | 2013 | 212,370 | 71,057 | 283,427 | ||||||||||

Executive Vice President, Chief Operating Officer and Corporate Secretary of Cortland and the Bank | 2012 | 214,170 | 62,847 | 277,017 | ||||||||||

David J. Lucido | 2013 | 139,725 | 87,900 | 227,625 | ||||||||||

Senior Vice President and Chief Financial Officer of Cortland and the Bank | 2012 | 139,725 | 78,858 | 218,583 | ||||||||||

| (1) | Includes salary deferred at the election of the executive under the Bank’s 401(k) retirement plan. |

| (2) | The figures in the “all other compensation” column consist of the Bank’s contribution to the 401(k) plan accounts for the named executive officers, the imputed monetary value of life insurance policies, vehicle-related expenses, club memberships, and accrual expense for benefits payable under the executives’ salary continuation agreements. For |

Administration of Cortland’s Compensation Programs.Cortland’s compensation programs for its executive officers are generally administered by or under the direction and supervision of Cortland’s Corporate Governance Committee, which is responsible for reviewing and recommending to the independent members of the Board of Directors for approval the salary, bonus and all other compensation and benefits to be provided to Cortland’s Chief Executive Officer and other executive officers.

The Company’s Chief Executive Officer and human resources manager annually review the compensation and performance of each executive officer of Cortland (other than the Chief Executive Officer, whose compensation and performance is reviewed by the Corporate Governance Committee). The results of these reviews are communicated to the Corporate Governance Committee, along with recommendations regarding compensation adjustments for the ensuing year. The Corporate Governance Committee either approves the recommended compensation adjustments or makes modifications in its discretion. The Corporate Governance Committee then makes its final recommendations to the independent members of the Board of Directors for approval.

In setting salaries for Cortland’s executive officers, the Corporate Governance Committee and human resources manager use pay ranges that are established based on publicly available market data regarding compensation paid to similarly situated executive officers at other companies. Pay ranges are established and adjusted periodically with reference to market data from publicly available compensation surveys. For each employee position or category within Cortland, the pay range that is established includes a minimum, a mid-point and a maximum salary. Although the Corporate Governance Committee generally does not target a specific point within the pay range for executive officer salaries, the Corporate Governance Committee strives to ensure that its executive officer compensation remains competitive with the compensation provided by other financial institutions with which Cortland competes for executive talent.

Severance Agreements. We entered into severance agreements with Messrs. Gasior, Carney Feret, and GasiorLucido in September 2012, superseding their previous agreements. A copy of the September 2012 severance agreement of these executives is included as an exhibit to the Form 8-K Current Report that we filed with the SEC on October 3, 2012.

Messrs. CarneyGasior and GasiorCarney are entitled by their severance agreement to an immediate lump-sum cash payment if a change in control occurs. The amount of the payment is a multiple of2.99 times the sum of their base salary and the most recent annual bonus: 2.99 times the sum of salary and bonus in Mr. Gasior’s case and 2.50 in Mr. Carney’s.bonus. If the executive’s employment terminates involuntarily but without cause or voluntarily because of an adverse change in employment circumstances to which he did not consent in advance, in either case with termination occurring within 24 months after a change in control, he would also be entitled to continued medical, dental, accident, disability, and life insurance coverage for up to three years. Mr. Feret’sLucido’s severance agreement is similar to that of Messrs. CarneyGasior and Gasior,Carney, except that (x) the change-in-control benefit of Mr. FeretLucido is 2.00 times compensation and (y) the change-in-control benefit is payable if and only if Mr. Feret’sLucido’s employment is terminated within 24 months after a change in control, whether because of involuntary termination by Cortland without cause or voluntary termination by Mr. FeretLucido because of a material adverse change in employment circumstances to which he did not consent in advance.

The severance agreements of the executives have numerous common provisions, including a prohibition against competition with Cortland in Trumbull, Portage, or Mahoning Counties in Ohio for one year after employment termination. The executives are entitled to a payment equal to 1.0 times compensation after employment termination in exchange for the agreement not to compete, unless (x) they also receive or are entitled to receive change-in-control benefits under the severance agreement or (y) their employment termination occurs after age 65 or on account of retirement. Other common provisions of the severance agreements include these:

four miscellaneous, noncash benefits for employment termination occurring within two years after a change in control, specifically (1) continued club membership for three years, (2) tax and financial planning services for three years, (3) outplacement services for one year, and (4) medical, dental, accident, disability, and life insurance coverage for three years,

legal fee reimbursement of up to $500,000 if the severance agreement is challenged after a change in control,

a three-year term, renewing automatically each year for one additional year, and

the agreements employ the definition of the term change in control that is contained in Internal Revenue Code sectionSection 409A and implementing regulations.

If a change in control occurs and the total benefits or payments to which an executive is entitled constitute so-called “excess parachute payments” and are therefore subject to the 20% excise tax under Internal Revenue Code sectionsSections 280G and 4999 (whether under the severance agreement or under any other compensation arrangement), we must also make an adjusted gross-up payment to Messrs. Gasior, Carney Feret, and Gasior,Lucido, compensating them for the excise tax as well as for income, payroll, and excise taxes imposed on that parachute payment excise tax reimbursement payment. A 20% excise tax is imposed under sectionSection 4999 if the value of an executive’s aggregate change-in-control benefits – calculated according to procedures specified in sectionSection 280G and accompanying IRS regulations – equals or exceeds three times the executive’s five-year average taxable compensation. The five-year average is known as the base amount. If the value of the aggregate change-in-control benefits equals or exceeds three times the base amount, a 20% excise tax is imposed on all benefits exceeding the base amount and the employer forfeits its compensation deduction for those same benefits. The total adjusted gross-up payment to Messrs. Gasior, Carney Feret, and GasiorLucido would consist of (1) a payment equal to the initial excise tax and (2) a gross-up payment that is equal to 80% of the difference between (x) the amount that would fully compensate the executives for all income, payroll, and excise taxes imposed on the excise tax reimbursement payment and (y) the excise tax payment itself. The gross-up benefit is not deductible compensation.

Salary Continuation Agreements. Messrs. Gasior, Carney Feret, and GasiorLucido are also parties to salary continuation agreements with The Cortland Savings and Banking Company. A copy of the agreement of Mr. CarneyGasior and Mr. GasiorCarney – the March 27, 2012 Fifth Amended Salary Continuation Agreement – is included as an exhibit to our Form 10-K Annual Report for the year ended December 31, 2011, which we filed with the SEC on March 29, 2012. A copy of Mr. Feret’sLucido’s June 1, 2010 Salary Continuation Agreement is included as an exhibit to the Form 8-K Current Report that we filed with the SEC on June 2, 2010.

The salary continuation agreements provide Messrs. Gasior, Carney Feret, and GasiorLucido with an annual normal retirement benefit payable for 15 years, beginning at age 65 and payable regardless of whether the executives continue working past age 65. The annual benefit amount is $109,700 for Mr. Gasior, $112,500 for Mr. Carney $92,000and $80,900 for Mr. Feret, and $109,700 for Mr. Gasior.Lucido. A reduced

benefit is payable for termination before attaining age 65, the amount of the reduced benefit being the amount that amortizes over 15 years the liability accrual balance existing when termination occurs. Mr. Feret’sLucido’s early termination benefit is also subject to a vesting requirement, vesting in equal 10% increments on the first ten anniversaries of the agreement’s June 1, 2010 effective date, but becoming fully vested if a change in control first occurs. For termination before full vesting, Mr. Feret’sLucido’s early termination would be based on the vested accrual balance. If a change in control occurs before attaining age 65, instead of an annual retirement-age benefit Mr. CarneyGasior and Mr. GasiorCarney would be entitled to an immediate lump-sum payment equal to the liability accrual balance projected to exist at their age 65 normal retirement age, but the payment would be discounted to present value. After a change in control Mr. FeretLucido would be entitled to a lump-sum payment equal to the existing liability accrual balance, but only if within 24 months after the change in control Mr. Feret’sLucido’s employment termination occurs involuntarily but without cause or voluntarily on account of an adverse change in employment circumstances to which he did not consent in advance. The salary continuation agreements employ the definition of the term change in control that is contained in Internal Revenue Code sectionSection 409A and implementing regulations.

The salary continuation agreements of Messrs. CarneyGasior and GasiorCarney were amended in March of 2012, with the Fifth Amended Salary Continuation Agreements replacing the Fourth Amended agreements. The Fifth Amended agreements eliminated the vesting condition that applied to the early termination benefits of Messrs. Carney and Gasior. However, the Fifth Amended agreements add a promise on their part that for two years after employment termination they will not compete with Cortland. Like the severance agreements, the salary continuation agreements provide for reimbursement of up to $500,000 in legal expenses for the executives if the agreements are challenged after a change in control occurs.